[Policy Update] The National Energy Administration Issues the “Guiding Opinions on Promoting the Integrated and Coordinated Development of New Energy”

📰 News Highlight

Recently, the National Energy Administration (NEA) issued the Guiding Opinions on Promoting the Integrated and Coordinated Development of New Energy, aiming to fundamentally accelerate the shift in new energy development from a "stand-alone operation" model to one of "integrated and coordinated development".

⚙️ Core Components

1. Optimizing the power mix and storage configuration in large “sand-gobi-desert” renewable bases, building CSP, pumped hydro, and new storage to improve grid coordination and explore 100% renewable bases.

2. Strengthening wind-solar-hydrogen-storage integration, develop green hydrogen, ammonia, and methanol industrial bases, and promoting broader end-use adoption in transport, industry, and buildings.

💡 Key Takeaways

1. Marking a crucial transition for new energy development from merely emphasizing scale expansion to focusing on system integration, operational reliability, and high-quality utilization.

2. Mandating that new energy projects must be deeply integrated with the power system's regulation capabilities.

3. Emphasizing the synergy between new energy and industry, encouraging the establishment of manufacturing bases in areas rich in new energy resources to achieve Green Manufacturing.

[Market Update] Official Guide Issued on Using CCERs to Offset Emission Quotas in China's National Carbon Market

📰 News Highlight

Recently, the China Carbon Emission Registry and Settlement Co., Ltd. (CCEERS) issued the Announcement on the Release of the Operation Guide for Key Emission Units to Offset Quota Clearance using CCERs in the National Carbon Emission Trading Market. It, following the re-establishment of the CCER market, clarifies the full operational workflow, covering account opening, the transfer of CCERs, and the formal submission and processing of the offset application.

💡 Key Takeaways

1. Formalizing the national carbon market's compliance mechanism, providing necessary clarity and certainty on how to legally and procedurally use voluntary carbon credits.

2. Defining the precise steps for using CCERs for quota clearance, unlocking compliance demand, improving liquidity, trading activity, and price signals for project developers.

3. Linking the ETS with the voluntary market, encouraging broader emission-reduction projects and strengthening China’s dual-carbon policy.

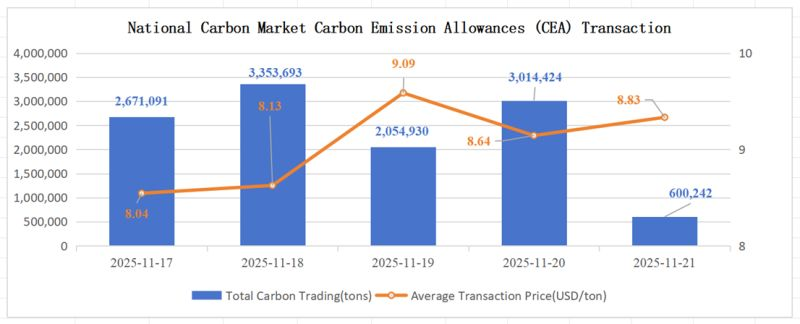

[Carbon Market]

During November 17 – November 21, the total transaction volume of Carbon Emission Allowances (CEA) in Chinese National Carbon Market reached 11,694,380 tons, with a total transaction value of USD 98,765,124.03. The highest price was USD 9.09/ton, and the lowest price was USD 8.04/ton. For bulk agreement transactions, the volume was 7,845,864 tons, with a transaction value of USD 63,532,594.02.

Address:Room 512B, Shenzhen CBD Landmark, No. 4028 Jintian Road, Futian District, Shenzhen

Email:info@governance-solutions.com

Address:Room 709, Block C, Vantone Center, No. A6 Chaoyangmen Outer Street, Chaoyang District, Beijing

Email:info@governance-solutions.com

Address:Floor 12, China Resources Times Square, No.500 Zhangyang Road, Pudong New Area, Shanghai

Email:info@governance-solutions.com

Address:Level 16, The Hong Kong Club Building, 3A Chater Road, Central, Hong Kong

Email:info@governance-solutions.com

© 2021-2024 Governance Solutions Group All Rights Reserved. 粤ICP备2022043806号

Contact Us: +86 755 8388 1959