[Policy Update] MOF and Regulators Issue "Sustainability Disclosure Standards for Enterprises No. 1 — Climate (Trial)"

📰 News Highlight

The Ministry of Finance (MOF), in collaboration with relevant departments, officially released the "Sustainability Disclosure Standards for Enterprises No. 1 — Climate (Trial)". As China's first nationwide climate-specific information disclosure standard, it applies to domestic listed companies and other key enterprises, marking a milestone in the construction of China's corporate climate disclosure system.

⚙️ Core Components

1. Four-Pillar Framework: Aligned with international benchmarks (such as IFRS S2), requiring disclosure of governance, strategy, risk management, and metrics & targets related to climate change.

2. GHG Emissions: Focusing on GHG emissions, mandating disclosure of Scope 1, Scope 2, and material Scope 3, as well as carbon pricing impacts and decarbonization pathways.

3. Opportunity Integration: Encouraging enterprises to disclose climate-related opportunities, forcing a transition from simple environmental reporting to strategic financial and operational integration.

💡 Key Takeaways

1. Global Convergence with Chinese Characteristics: Aligned with ISSB, China enhances global comparability while embedding local priorities, forming a global–local hybrid model.

2. The Scope 3 Challenge: Mandatory Scope 3 disclosure drives supply-chain data reporting, affecting SMEs indirectly.

3. Data as a Financial Asset: Standardized climate data supports ESG finance, reduces greenwashing, and enables risk assessment.

[Market Update] CMA Releases China’s First Blue Book on Climate Resource Economy (2025)

📰 News Highlight

The China Meteorological Administration (CMA) officially released the Blue Book of Climate Resource Economy: Research Report on China’s Climate Resource Economy Transformation (2025). As the nation’s first comprehensive publication in this field, the Blue Book systematically outlines how meteorological elements—such as wind, solar radiation, and atmospheric landscapes—are being transformed into tangible economic value.

💡 Key Takeaways

1. Agricultural Expansion & Food Security:Climate shifts enable northward expansion of corn belt (~61m mu), strengthening food security.

2. Precision Energy Dispatching:Improved wind & solar forecasting accuracy boosts energy efficiency and financial performance.

3. "Meteorology +" Economy & Tourism: Climate phenomena monetized into tourism products via meteorological landscape indices.

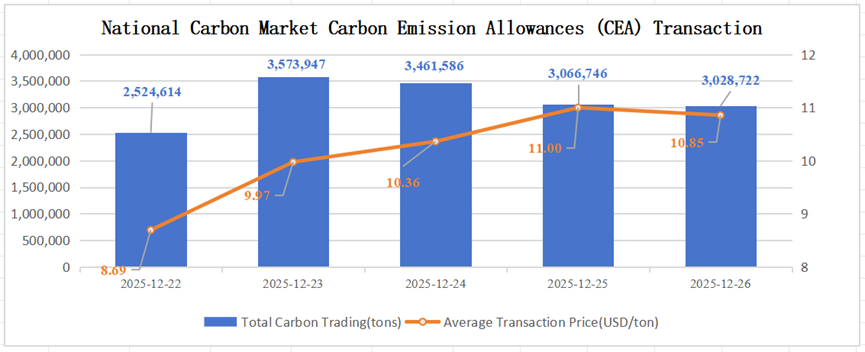

[Carbon Market]

During December 22 – December 26, the total transaction volume of Carbon Emission Allowances (CEA) in Chinese National Carbon Market reached 15,655,615 tons, with a total transaction value of USD 160,062,685.31. The highest price was USD 11.00/ton, and the lowest price was USD 8.69/ton. For bulk agreement transactions, the volume was 11,800,947 tons, with a transaction value of USD 119,490,245.41.

Address:Room 512B, Shenzhen CBD Landmark, No. 4028 Jintian Road, Futian District, Shenzhen

Email:info@governance-solutions.com

Address:Room 709, Block C, Vantone Center, No. A6 Chaoyangmen Outer Street, Chaoyang District, Beijing

Email:info@governance-solutions.com

Address:Floor 12, China Resources Times Square, No.500 Zhangyang Road, Pudong New Area, Shanghai

Email:info@governance-solutions.com

Address:Level 16, The Hong Kong Club Building, 3A Chater Road, Central, Hong Kong

Email:info@governance-solutions.com

© 2021-2024 Governance Solutions Group All Rights Reserved. 粤ICP备2022043806号

Contact Us: +86 755 8388 1959